Debt Management & Financial Wellbeing

Debt Counselling, also known as Debt Review, is a legal debt relief process established under the National Credit Act 34 of 2005 and introduced in 2007. It is designed to assist consumers who are struggling to meet their monthly debt obligations

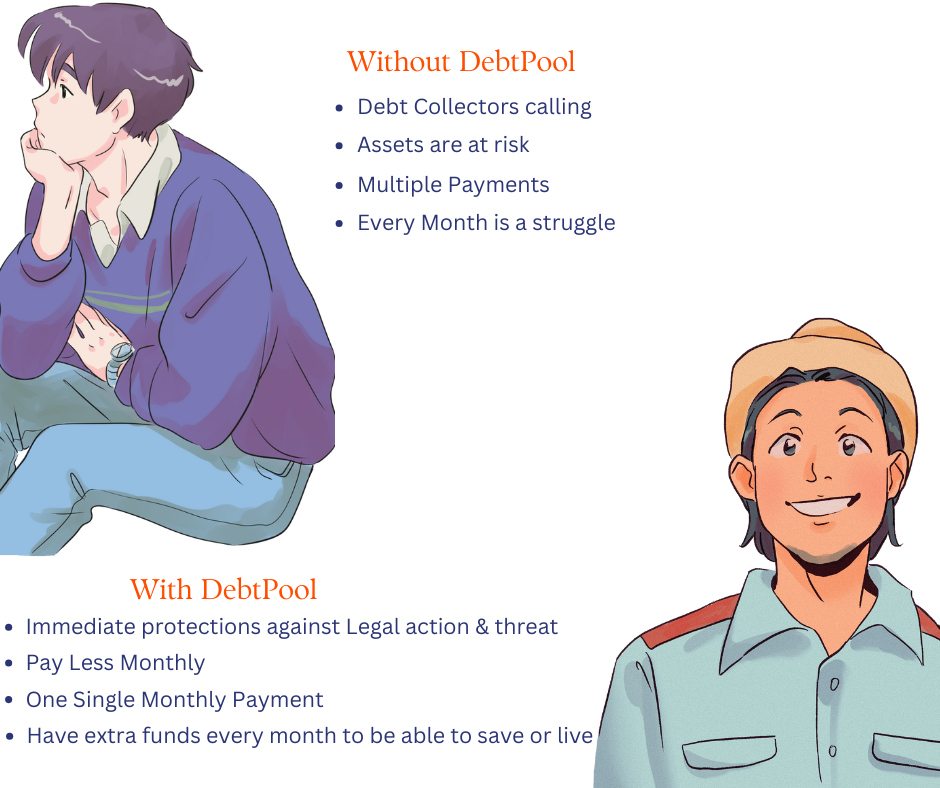

How can DebtPool help you ?

We start with a process called Debt Counselling:

- Telephonic consultation where we will review your situation with you and advise on where to possibly improve.

- We will focus on where you could get more out of your budget.

- The main aim is to get you to a point where you have spare funds to save and create pockets for savings, emergency funds or just some breathing room!

- Ultimately we will use the assessment to confirm if you are eligible for a process called Debt Review.

We follow a formal legal process (Debt Review) where formalised application forms and documents are used. This process is regulated by the National Credit Regulator.

Here is more information https://www.ncr.org.za/index.php/departments/debt-counselling

Example of Mr Gellar

Total Monthly Commitments Include

- Living Expenses (Accommodation, Groceries, Transport, Telephone, School Fees and other e.g Gardener)

- Financial Services (Insurance, Medical Aid and other e,g Savings)

- Credit Provider Repayments (Home Loans, Vehicle Loans, Personal Loans, Credit Cards, Store/Clothing Accounts and other e.g Overdraft )

Understanding Our Process

Contact Me

Would you like to know more about DebtPool and Debt Counselling/Review ? Check out our FAQ’s